Australia's proposed climate-related financial reporting system

Growing awareness of the financial risks and opportunities presented by climate change has caused investors to increasingly demand that businesses provide high-quality, globally comparable information on such risks and opportunities. The need for consistent international requirements led to the establishment of the International Sustainability Standards Board (ISSB), which has developed comprehensive global standards for sustainability reporting and climate-related disclosures.

Several countries, including Australia, have implemented or are planning to implement mandatory climate-related disclosure requirements for businesses. This article provides an outline of these standards and how they will be implemented in Australia.

What are the international standards?

The ISSB released its first two sustainability standards in June 2023:

- IFRS S1 General Requirements for Disclosure of Sustainability-related Financial Information, which sets out requirements for entities to disclose information about the sustainability and climate-related risks that they face over the short, medium, and long term

- IFRS S2 Climate-related Disclosures, which sets out specific climate-related disclosures and is designed to be used with IFRS S1.

The standards were designed to provide a global baseline of sustainability-related disclosures, but also allow countries to develop additional requirements if necessary.

How will the international standards be applied in Australia?

In order to address the specific requirements of Australia’s economic environment, modifications to the IFRS standards are essential. The Australian standards will include changes to facilitate the integration of Australia’s national greenhouse gas emissions estimation methodologies and ensure compliance with international climate change commitments, among other things.

The three Australian Sustainability Reporting Standards (ASRS) that Australia is proposing to adopt are:

- ASRS 1 General Requirements for Disclosure of Climate-related Financial Information, which prescribes how an entity is to prepare and report its climate-related financial disclosures as part of its general purpose financial reporting, including:

- general requirements for the presentation of those disclosures

- guidelines for their structure

- minimum requirements for their content

- ASRS 2 Climate-related Financial Disclosures, which sets out the requirements for an entity to provide useful information to primary users of its general purpose financial report about climate-related risks and opportunities that could reasonably be expected to affect:

- the entity’s cash flows, access to finance or cost of capital over the short, medium or long term, and

- in relation to a not-for-profit entity, its ability to further its objectives

- ASRS 101 References in Australian Sustainability Reporting Standards, which provides an up-to-date listing of external documents referenced in ASRS 1 and ASRS 2.

What are the proposed changes to legislation?

To prescribe these new climate-related financial reporting requirements, the Australian Government is proposing amendments to the Corporations Act 2001. The changes will ensure that relevant entities disclose their climate-related plans, financial risks and opportunities in accordance with the ASRS. These reporting requirements will need to be complied with by entities that:

- lodge financial reports under Chapter 2M of the Corporations Act 2001

- meet certain minimum size thresholds, and/or

- have emissions reporting obligations under the National Greenhouse and Energy Reporting (NGER) scheme.

The amendments will add requirements for a new ‘sustainability report’, which is to be included as part of an annual financial report. The sustainability report will consist of:

- the climate statement for the year, prepared in accordance with the ASRS

- notes to the climate statement

- any statements prescribed by the regulations

- the directors’ declaration about the compliance of the statements with the relevant sustainability standards.

What has Australia done so far to implement the standards?

The Australian Government has undertaken consultation with stakeholders to inform the development of Australia’s climate-related financial disclosure requirements:

- The first round of consultation was undertaken from December 2022 to February 2023, and sought initial views on the design and implementation of the standard.

- A second consultation, which focused on the detailed implementation and sequencing of standards, took place from June to July 2023.

- A draft of the amending legislation that would implement the reporting requirements was released for consultation from January to February 2024. A Policy Impact Analysis and Policy Position Statement was also released at this time.

- The Australian Accounting Standards Board (AASB) carried out consultation from October 2023 to March 2024 on drafts of the Australian standards.

Although the standards are not yet mandatory, changes have already been made to legislation to establish the framework for the development of sustainability standards. The amendments made by Schedule 2 of the Treasury Laws Amendment (2023 Measures No. 1) Act 2023 provide the AASB and the Auditing and Assurance Standards Board (AUASB) with the necessary functions to develop sustainability standards and associated auditing and assurance standards, and empowers the Financial Reporting Council (FRC) to provide strategic oversight in relation to these sustainability related functions of the AASB and AUASB.

When do the reporting requirements commence?

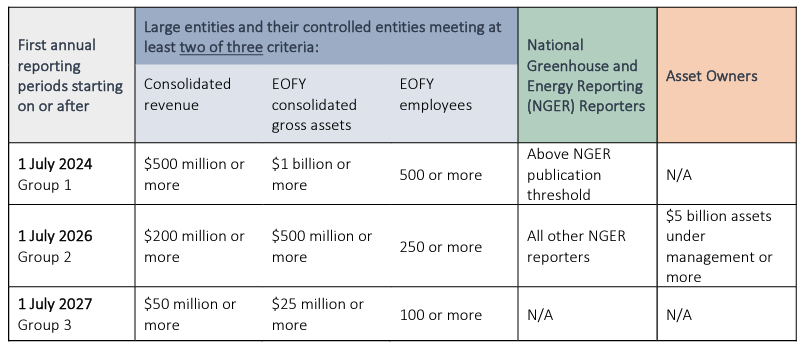

The amendments that will implement the mandatory climate-related financial disclosure requirements are expected to commence on 1 July 2024. The requirements will be implemented for different entities in three phases, which will be based on an entity’s size or level of emissions.

It is proposed that Australia’s largest companies and financial institutions (classified as ‘Group 1’) will be required to comply with the mandatory disclosure requirements for annual reports for periods starting on or after 1 July 2024. Other businesses, which will be classified as ‘Group 2’ or ‘Group 3’, will be required to comply from 1 July 2026 and 1 July 2027, respectively. A transitional period will also be implemented to ensure that reporting entities are given time to develop experience in reporting to the required standards.

See below for a summary of the different Groups and their commencement dates. However, please be aware that these are proposed timeframes, and commencement dates and classification of Groups may change.

How EnviroLaw can keep you informed of the reporting requirements

Once the amending legislation has commenced, the standards and a summary of relevant legal requirements will be added to your EnviroLaw directory. Keep an eye on your monthly EnviroLaw Updates so you know when these requirements have commenced and can understand your legal obligations. In the meantime, you can stay informed about upcoming legislation changes and other news about climate-related disclosure through the monthly HSE Bulletin.

If you would like to add EnviroLaw to your current subscription, get in contact with your Account Manager.

If you don’t have an Environment Essentials subscription but interested to see how our products can help you understand and prepare for the climate-related financial reporting requirements, get in touch or sign up for a free trial.

Sources

- Australian Accounting Standards Board Publication: AASB Sustainability Reporting Exposure Draft

- Minister for Climate Change and Energy Media Release: Maximising Investment Opportunities and Managing Climate Risks

- IFRS Foundation Webpage: ISSB Issues Inaugural Global Sustainability Disclosure Standards

- IFRS Foundation Webpage: Ten Things to Know About the First ISSB Standards

- Treasury Laws Amendment (2023 Measures No. 1) Bill 2023 Explanatory Memorandum

- Treasury Publication: Treasury Laws Amendment Bill 2024: Climate-related Financial Disclosure – Exposure Draft Explanatory Materials

- Treasury Publication: Climate-related Financial Disclosure – Consultation Paper (June 2023)

- Treasury Publication: Climate-related Financial Disclosure – Consultation Paper (December 2022)

- Treasury Publication: Mandatory Climate-related Financial Disclosures – Policy Position Statement

- Treasury Publication: Policy Impact Analysis – Climate-related Financial Disclosures